The Wall Street Journal Editorial Board “The Coming Electricity Crisis” (published March 28) does a fine job identifying the current state of the electric grid in the US. But it implies a false choice: power AI and reverse grid decarbonization or don’t power AI and continue grid decarbonization. Or maybe it doesn’t even imply a choice: just power AI and reverse decarbonization.

I think there is a third path: Power AI and continue grid decarbonization responsibly. Transform data centers into grid assets providing flexibility back to the grid through a combination of curtailable load, batteries, and natural gas electric generation in lieu of diesel backup generators, which the industry heavily relies on today.

Several recent posts by Brian Janous, Sean James, and Jigar Shah highlight the opportunity for data centers to become grid assets by providing quick response flexibility back to the grid. There are different estimates on the amount of capacity that can be released when data centers are grid assets, and other loads become more flexible, but the scale is in 10s of GWs, potentially upwards of 100GW.

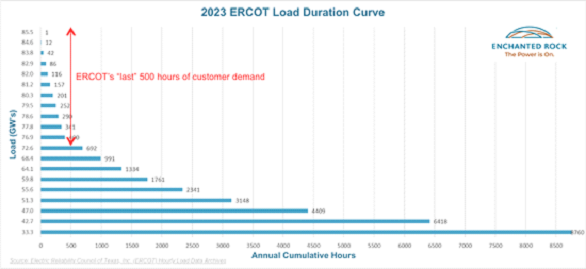

To understand why flexibility is so valuable in unlocking GWs of capacity to serve new electric load, a load duration curve is helpful, like this one showing ERCOT’s 2023 historical load data.

Utilities are falling short in meeting customer demands not in new baseload generation but for an estimated 100-500 hours a year during peak spikes in demand. Looking at ERCOT’s historical load data from 2023, the “last” 500 hours of demand during peaks was only 10 GW, a gap that new data centers could bridge through a combination of curtailable load, batteries, and natural gas electric generation.

In other words, ERCOT needs 10 GW to serve the ‘last’ 500 hours of customer demand. When a data center asks for firm capacity, or power serving all 8,760 hours in a year, this further exacerbates the spike of peak customer demand.

Utilities and the press respond accordingly and talk about all the new baseload generation that needs to be added. However, when a data center can curtail load for those 500 hours by temporarily stopping a power-intensive (but not time-critical) process, using batteries, or turning on on-site generation, they can tap into the electric generation surplus available in the 8760-500 hours/year and avoid adding to the peak. In doing this, the data center becomes a grid asset, especially if it can provide surplus flexibility back to the grid. In a world of heavy renewables penetration, this flexibility becomes even more important, as the WSJ op-ed pointed out, as it buffers the intermittency of wind and solar and increases the grid’s ability to host even more renewables (thus accelerating decarbonization).

I think it’s important to note that although batteries can be great grid assets in moving predictable mismatches of load and renewables generation, they typically don’t have the duration and unconstrained dispatch that grid operators need, especially in situations that are multiple day events, like winter storms, where a battery recharging will hurt the grid. You still need a fuel to cover long-duration outages and Enchanted Rock‘s preference is natural gas, which can be fully decarbonized through renewable natural gas offsets. Natural gas generation can literally be several orders of magnitude cleaner than the diesel backup it replaces, and significantly more reliable for extended outages and grid instability events, if purchased with embedded storage and firm transportation to the data center.

I’m hopeful the narrative can change soon to how the major AI players Amazon Web Services (AWS), Microsoft AI, AI at Meta, and Google Cloud can shift from adding to the problem to becoming the solution by working with regulated utilities and deregulated grid operators to unlock existing electrical generation capacity and continue the decarbonization journey.

This article was originally posted on Thomas McAndrew’s LinkedIn profile.